What does Bayesian Probability say about Bitcoin?

As a trader of futures contracts, I have been a devotee of Bayesian Probability Theory for many years.

In contrast to the dogmatic “one-and-done” probability approaches practiced by so many novice market speculators, devotees of Bayesian Probability Theory assign a probability to a future event, then adjust that probability as new information becomes known (or suspected).

From the very onset of my involvement with Bitcoin in 2016 at a price below $500 per, I have orbited around the idea that BTC had a 50% chance to go to $100,000, $250,000, $1,000,000 (you name the price) and a 50% chance to become the modern edition of the Pet Rock and the Beanie Baby.

Of course over the course of time I have modified these probabilities largely based on several proprietary tools of technical price analysis.

On April 26, 2024 I issued a blog post titled, “Does History Make a Case that Bitcoin has Topped?” At the time Bitcoin was trading around $64,000, having made a high of $73,835 on Mar 14. This high continues to mark a top. This analysis can be accessed here:

A tentative price projection in this analysis was the low $30,000 range — and at the time I established in my own mind things that had to happen for me to increase the odds of such an event.

For the sake of balance, on May 3, 2024 I made another blog post, this one forecasting a continuation of Bitcoin’s historic bull trend.

On June 2 with Bitcoin trading above $65,000 I established the initial price target of $140,000 for this alternative view.

Two differing views???? Is that not inconsistent with proper market analysis??? Not at all, creating alternative narratives and then monitoring those narratives based on price action is entirely consistent with Bayesian Probability.

In contrast to my 2016 alternatives of “Pet Rock vs. $1,000,000, in early June I was assigning a 50% probability of $30,000 (approximately a 50% price decline) and a 50% chance of $140,000 (approximately a doubling of price).

Since June my technical price indicators have been stacking up in favor of the $30,000 probability. Currently my Bayesian Probability for sub-$40,000 is at 65% with a yet to be achieved top at $80,000 at 20% and an advance during this halving cycle to $130,000 by September 2025 at 15%.

Welcome to the World of Bayesian Probability where the odds of outcomes change as new information is discovered.

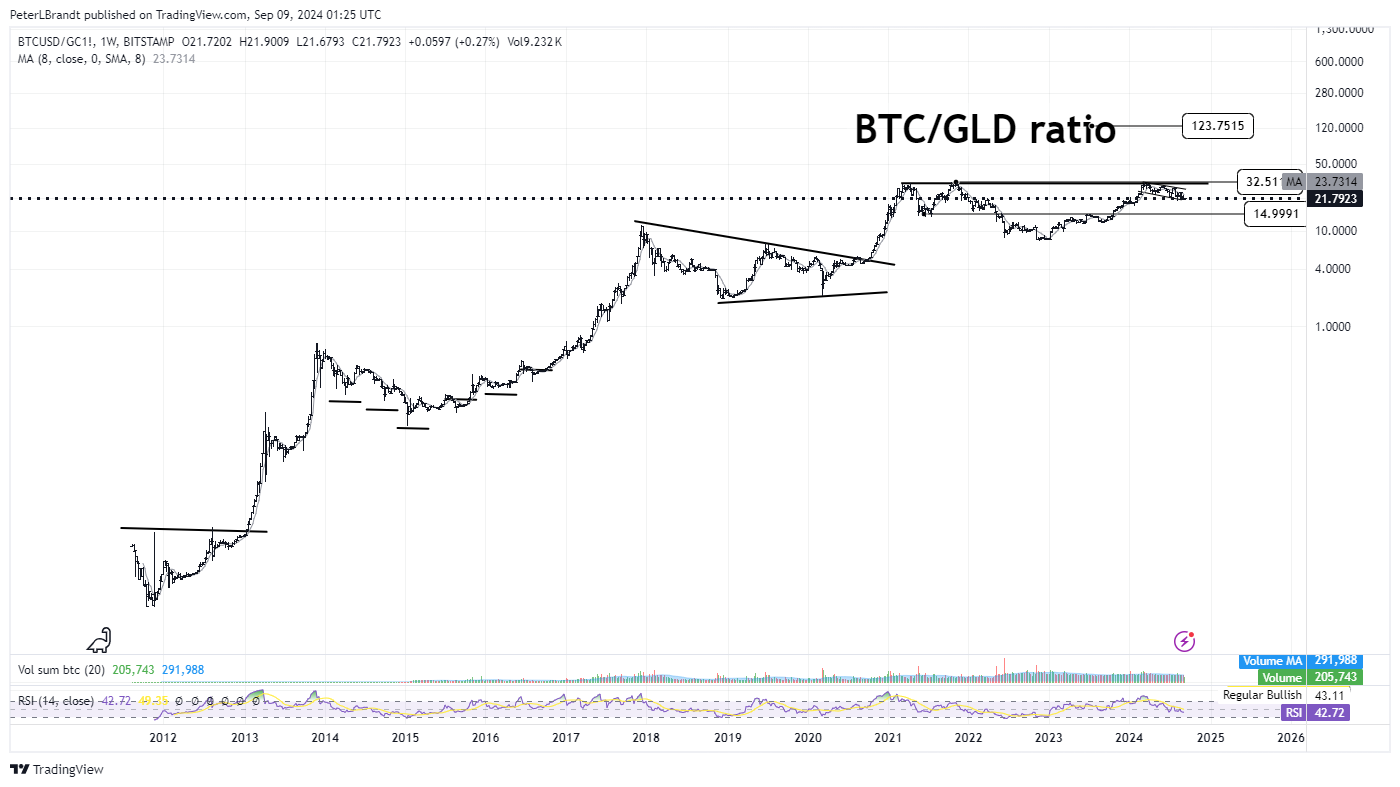

Several things need to occur for me to begin stacking the odds back in favor a pending bull market advance. I will save these requirements for another day, but will leave you with one chart to consider. Despite the introduction in the U.S. of Bitcoin ETFs, accelerating U.S. government debt, another halving cycle and plenty of hype, the price of Bitcoin expressed in Gold has made a series of lower highs throughout 2024 and remains well below highs registered in 2021. I favor the probability that the BTC/Gold ratio could reach 15 to 1 during a continuing period of price weakness.

End.

In financial market Bayesian is wrong, Frequentist is right. It is too complex to use Bayesian to explain the market.

Excellent mind-challenging education in holding and adjusting for 2 opposite outcomes...just what us optimistic HODL folk need. Thanks Peter.